The Clark Wealth Partners Statements

Not known Incorrect Statements About Clark Wealth Partners

Table of ContentsClark Wealth Partners Things To Know Before You BuyClark Wealth Partners Fundamentals ExplainedClark Wealth Partners Fundamentals Explained10 Easy Facts About Clark Wealth Partners ShownThe Basic Principles Of Clark Wealth Partners

Their role is to assist you make notified choices, stay clear of costly errors, and stay on track to fulfill your long-term goals. Managing funds can be challenging, and emotions commonly shadow judgment when it involves money. Fear and greed, for circumstances, can bring about impulsive choices, like panic-selling throughout a market decline or going after choices that do not line up with your threat tolerance.

It is essential to comprehend their cost structure and ensure it fits your economic situation. For numerous individuals, the experience, objectivity, and tranquility of mind that an expert offers can be valuable, yet it is very important to take into consideration the linked prices. Just as athletes, fitness instructors, and instructors help individuals accomplish their finest in various other areas of life, an economic advisor can play a vital role in aiding you construct and protect your financial future.

Investors need to make financial investment decisions based upon their one-of-a-kind financial investment objectives and financial circumstance (http://nationlisted.com/directory/listingdisplay.aspx?lid=41525). ID: 00160363

The 3-Minute Rule for Clark Wealth Partners

It's about assisting customers to browse adjustments in the atmosphere and recognize the influence of those adjustments on a continuous basis," states Liston. An adviser can also aid customers manage their properties a lot more efficiently, states Ryan Nobbs, an economic advisor for M&G Wide range Suggestions. "Whereas a customer may have been conserving previously, they're now going to begin to attract an earnings from various assets, so it's concerning putting them in the appropriate products whether it's a pension, an ISA, a bond and afterwards attracting the revenue at the right time and, critically, maintaining it within specific allowances," he claims

Retirement preparation is not a one-off event, either. With the appeal of earnings drawdown, "financial investment doesn't quit at retirement, so you need a component of competence to recognize exactly how to get the ideal blend and the appropriate equilibrium in your investment options," says Liston.

The Only Guide to Clark Wealth Partners

For instance, Nobbs had the ability to assist among his clients move money right into a range of tax-efficient items so that she could draw an income and would not need to pay any type of tax up until she had to do with 88. "They live pleasantly currently and her partner had the ability to take layoff because of this," he says.

"Individuals can come to be truly stressed out concerning exactly how they will certainly fund their retirement due to the fact that they don't recognize what setting they'll be in, so it pays to have a discussion with a monetary adviser," states Nobbs. While conserving is one apparent advantage, the value of suggestions runs much deeper. "It's all concerning offering individuals assurance, comprehending their needs and assisting them live the lifestyle and the retired life they want and to care for their household if anything ought to occur," says Liston.

Seeking financial recommendations may appear overwhelming. In the UK, that is sustaining an expanding guidance void just 11% of adults surveyed stated they would certainly paid for financial recommendations in the past two years, according to Lang Cat study.

This is understood as a limited suggestions service. With modifications in tax obligation regulation and pension regulation, and with any luck a long retirement in advance, individuals coming close to the end of their careers need to navigate a significantly challenging background to guarantee their financial needs will be met when they retire.

The 7-Second Trick For Clark Wealth Partners

"If you obtain it wrong, you can wind up in a collection of difficult scenarios where you may not be able to do the points you want to do in retired life," states Ross Liston, Chief Executive Officer of M&G Riches Recommendations. Looking for economic advice is a good idea, as it can aid individuals to enjoy a worry-free retired life.

While there's a riches of monetary preparation info available, it's progressively challenging to move on with a gauged method that does not panic or stay asleep at the wheel. An economic strategy customized to your particular situation develops purposeful value and assurance. And while it might be appealing to self-manage or utilize a robo-advisor to minimize specialist charges, this method can show costly in the future.

Below are the top five factors why employing a professional for financial guidance is helpful. While it might be tempting to self-manage or utilize a robo-advisor to save on expert charges, this approach can prove expensive in the lengthy run. A financial advisor who offers an independent and unbiased point of view is vital.

See This Report on Clark Wealth Partners

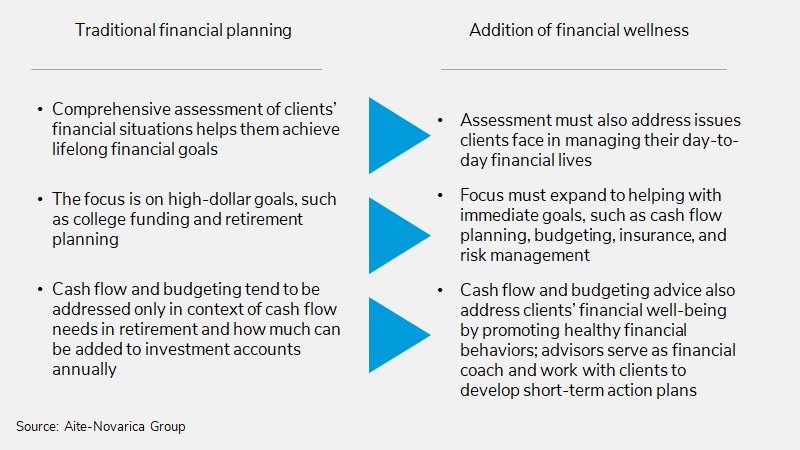

By comparison, capitalists that are functioning tend to worth retirement and tax obligation planning advice best. These searchings for may display some generational effect, considering that financial recommendations historically has actually been even more concentrated on investments than financial planning (financial advisor st. louis). The complexity of one's scenarios likewise might have an influence on the understanding of value

All told, people who pay for guidance ranked extra recommendations facets as really useful than those who did not. This outcome might suggest that finding value in more aspects triggers people to pay for guidance. The opposite could be real in some instances: Paying for an expert might reinforce the belief that the advantages are useful.

Since the economic climate changes and evolves each day, having a sane friend on your side can be a crucial factor for successful financial investment choices. Every person has his/her own economic circumstance and obstacles to deal with (https://www.tumblr.com/clarkwealthpt/801418794161569793/with-a-team-that-earns-ownership-and-shares). A financial organizer very carefully checks your existing possessions and liabilities, and future objectives to establish an individualised personal economic strategy